Rent-seeking in an emerging market: A DSGE approach - ScienceDirect

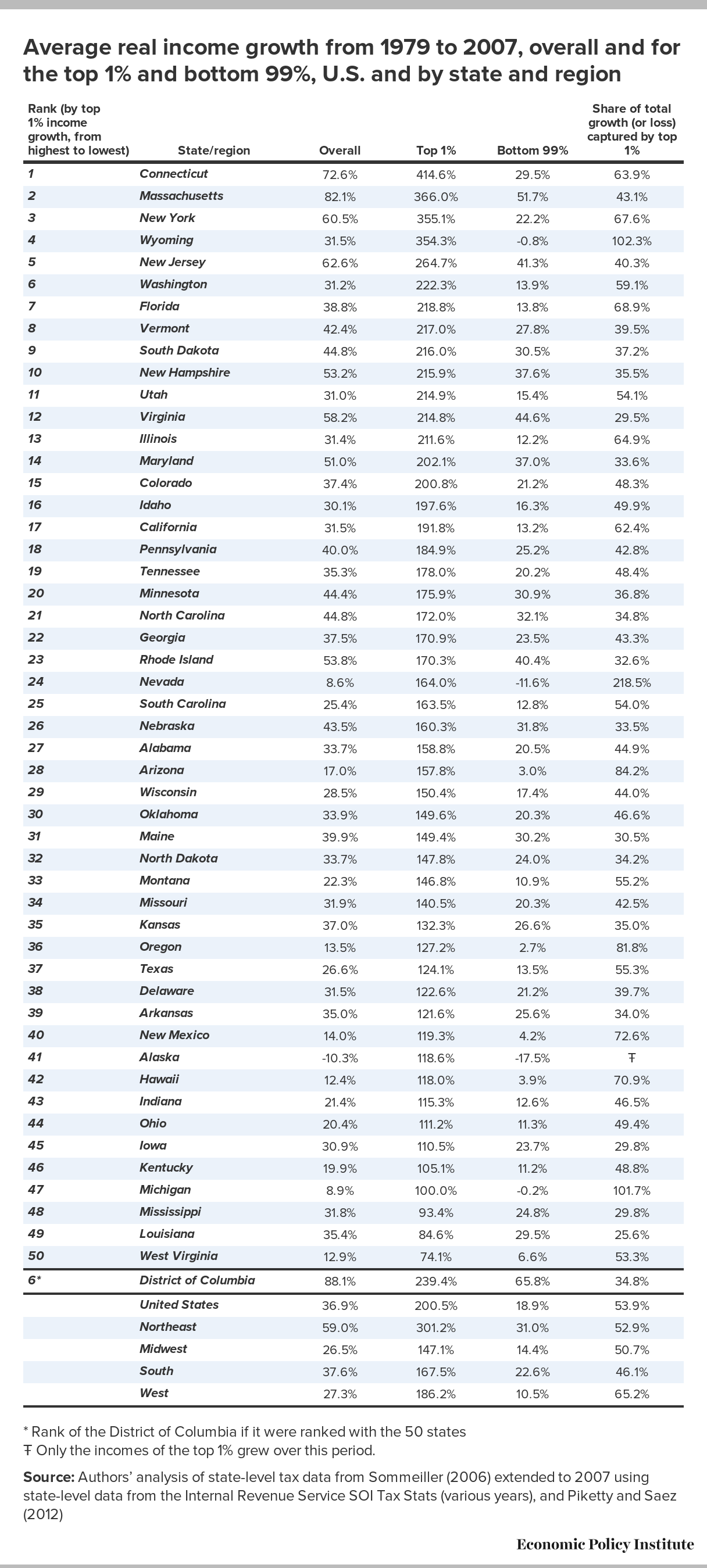

Income inequality in the U.S. by state, metropolitan area, and

Capital income taxation with housing - ScienceDirect

Image 38 of Taxes and returns under United States and

Challenges for companies during tax filing season Crowe Malaysia

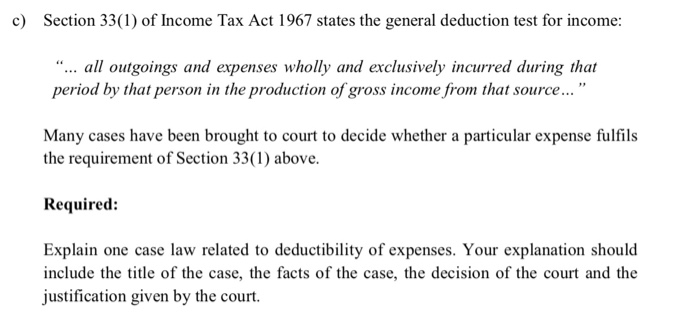

Solved c) Section 33(1) of Income Tax Act 1967 states the Chegg.com

Taxing the Rich More: Preliminary Evidence from the 2013 Tax

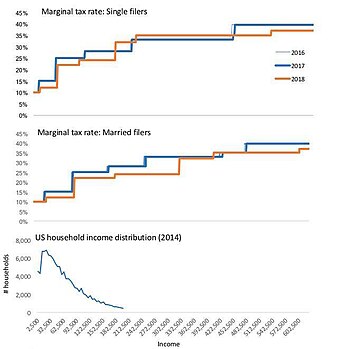

Tax Cuts and Jobs Act of 2017 - Wikipedia

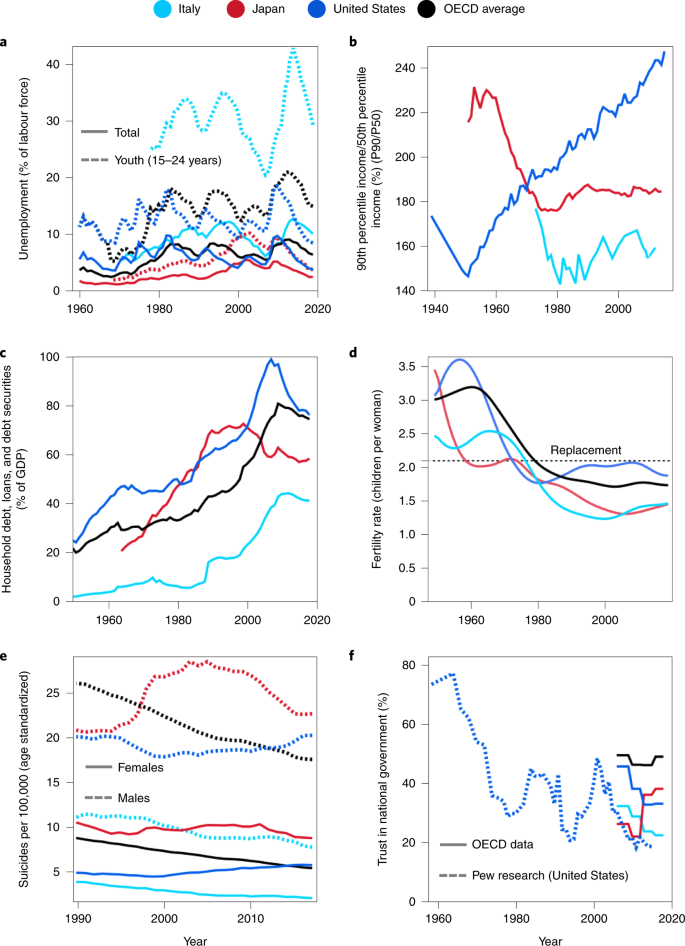

Prepare developed democracies for long-run economic slowdowns

Challenges for companies during tax filing season Crowe Malaysia PLT

Withholding Refund u/s 241A of Income Tax Act, 1961

Major Change in Section 43CA of The Income Tax Act, 1961 Tolerance limit is now 20%

Tags:

archive