Franklin & Marshall - F&M in the News 2020

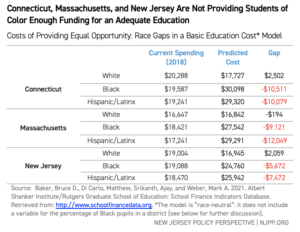

Report Archives - New Jersey Policy Perspective

Reasonable Cause to Avoid Tax Penalties

2012 California Proposition 30 - Wikipedia

Major Change in Section 43CA of The Income Tax Act, 1961 Tolerance limit is now 20%

cap. 55 income and business tax act - Income Tax Department, Belize

Major Change in Section 43CA of The Income Tax Act, 1961 Tolerance limit is now 20%

Chapter 3. Taxation of Companies. Definition. Tax Status of

Challenges for companies during tax filing season Crowe Malaysia PLT

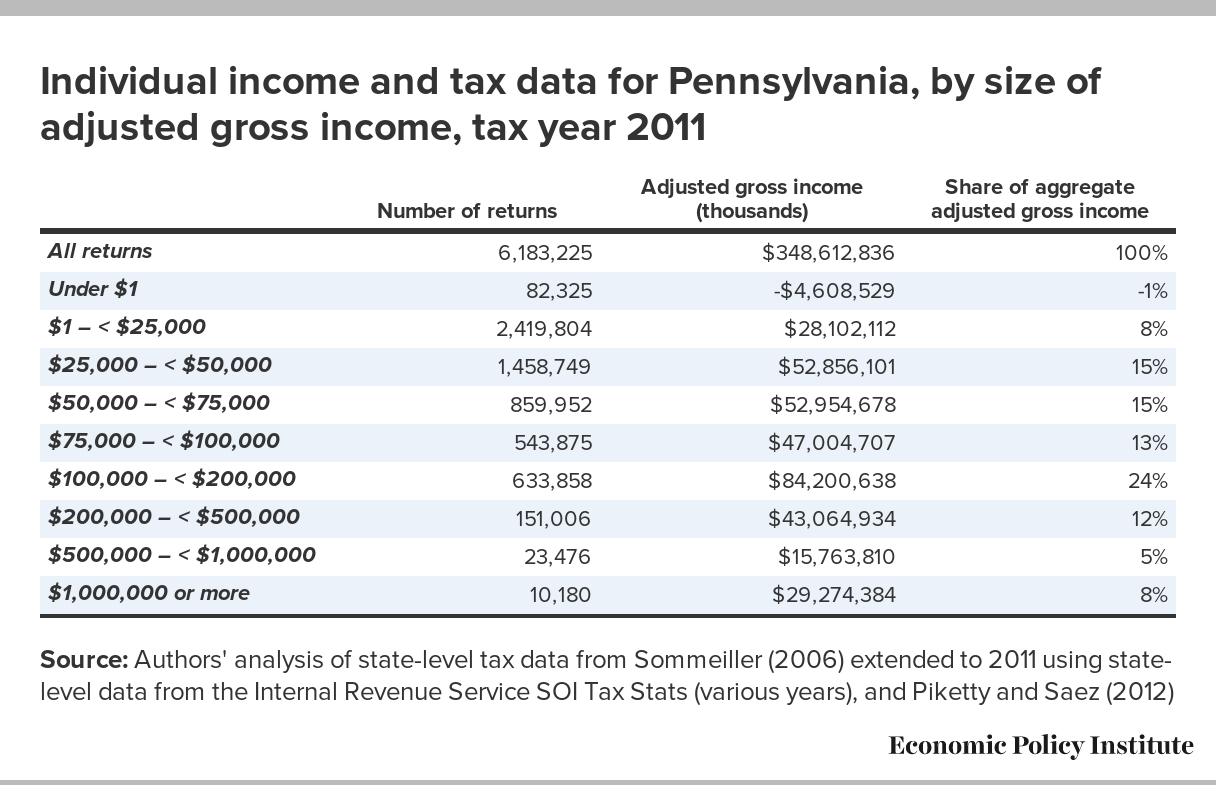

Income inequality in the U.S. by state, metropolitan area, and

Issue of section 131(1A) notice after conclusion of Income Tax

Challenges for companies during tax filing season Crowe Malaysia PLT

Tags:

archive