How Buoyant is the Tax System? New Evidence from a Large

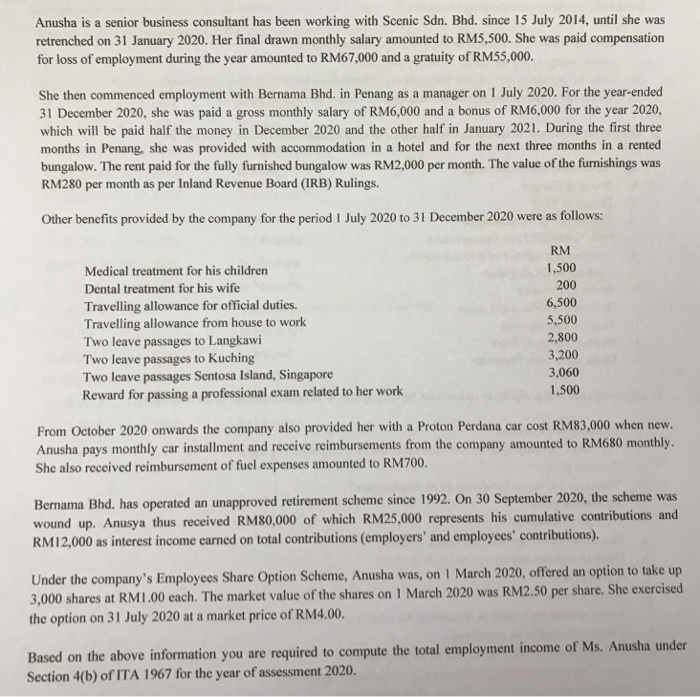

INCOME TAX EMPLOYMENT INCOME - COMPUTATION Section Chegg.com

39. Deductions not allowed.

eCFR :: 26 CFR Part 25 -- Gift Tax; Gifts Made After December 31, 1954

Crowe Chat Vol.8/2020 Crowe Malaysia PLT

39. Deductions not allowed.

Back Matter in: IMF Working Papers Volume 2019 Issue 051 (2019)

Taxing the Rich More: Preliminary Evidence from the 2013 Tax

1978 California Proposition 13 - Wikipedia

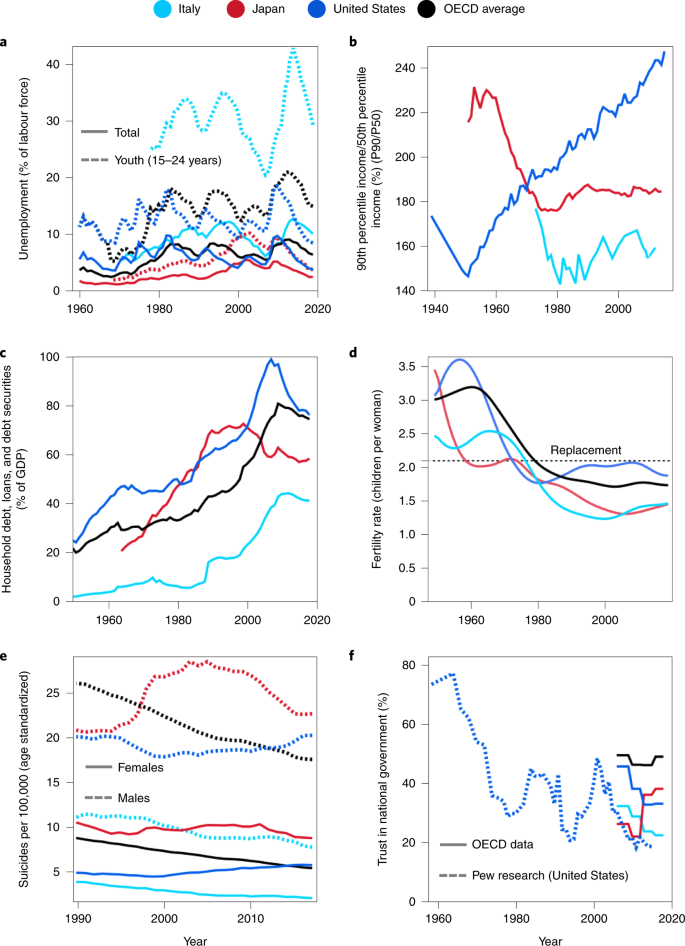

Prepare developed democracies for long-run economic slowdowns

Globalization and the Great U-Turn: Income Inequality Trends in 16

Major Change in Section 43CA of The Income Tax Act, 1961 Tolerance limit is now 20%

Tags:

archive