Macroeconomic Effects from Government Purchases and Taxes

Challenges for companies during tax filing season Crowe Malaysia PLT

SEC Filing Athira Pharma

Issue of section 131(1A) notice after conclusion of Income Tax

SEC Filing Athira Pharma

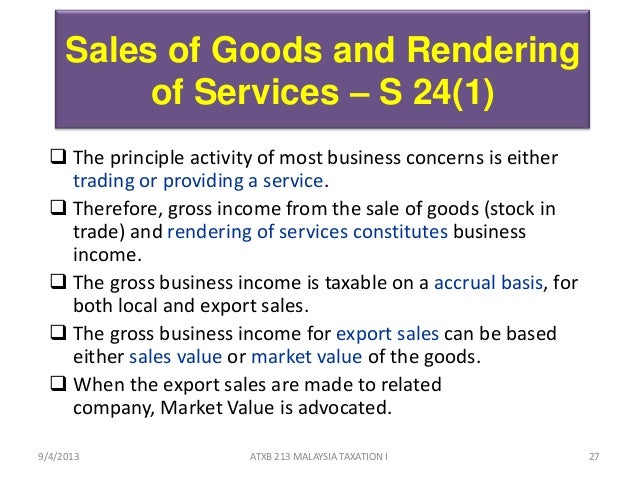

Section 24(1a) Income Tax Act 1967 - englshbda

USC02] FEDERAL RULES OF APPELLATE PROCEDURE

Section 24(1a) Income Tax Act 1967 - englshbda

Major Change in Section 43CA of The Income Tax Act, 1961 Tolerance limit is now 20%

Income Tax Treaty, Tax Treaties Database - Tax Notes

Section 24 1a Income Tax Act 1967

Crowe Chat Vol.8/2020 Crowe Malaysia PLT

Tags:

archive