39. Deductions not allowed.

Reasonable Cause to Avoid Tax Penalties

Capital income taxation with housing - ScienceDirect

Image 38 of Taxes and returns under United States and

Societies Free Full-Text Strong Welfare States Do Not

Globalization and the Great U-Turn: Income Inequality Trends in 16

USC02] FEDERAL RULES OF APPELLATE PROCEDURE

Macroeconomic Effects from Government Purchases and Taxes

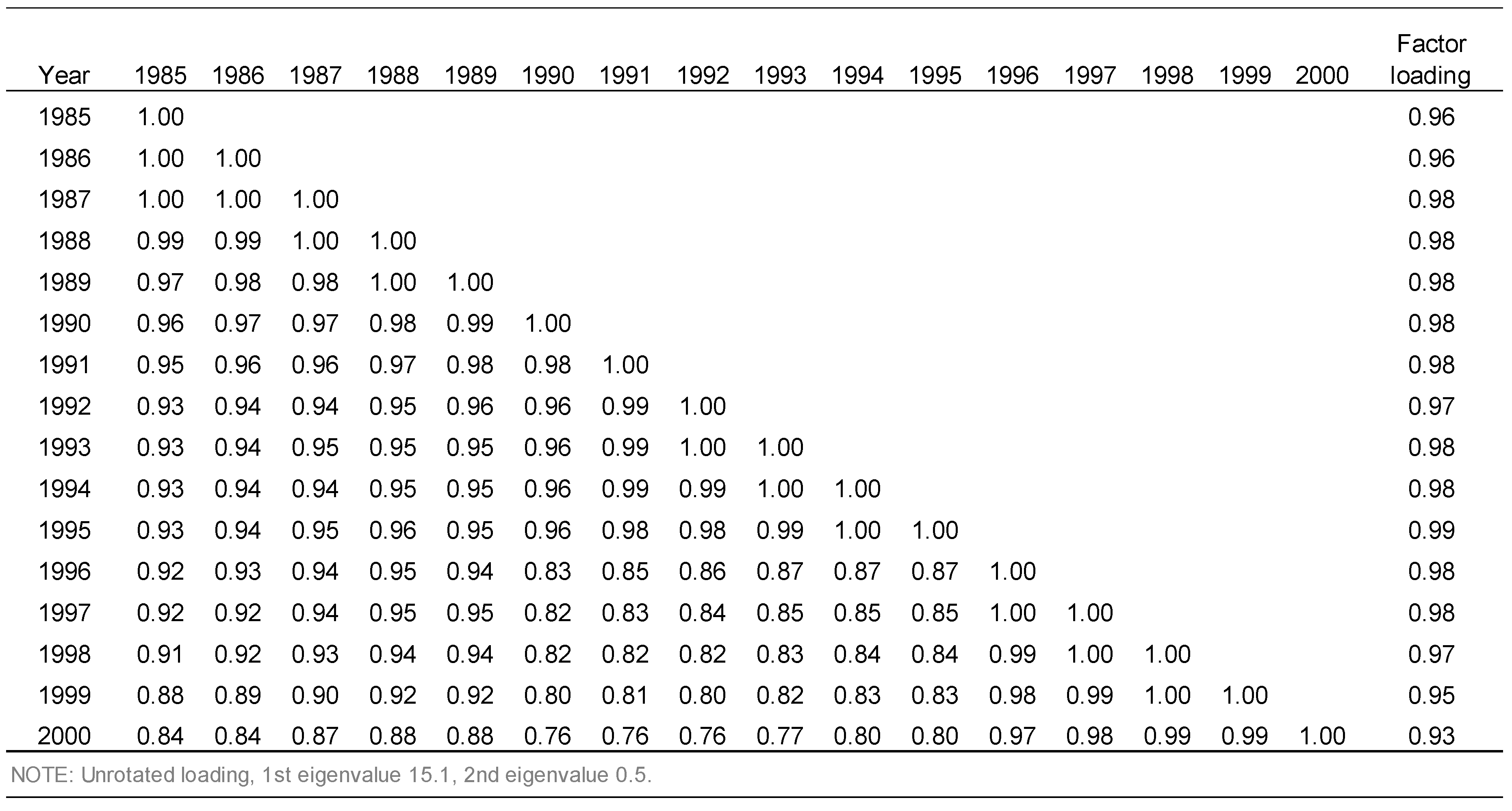

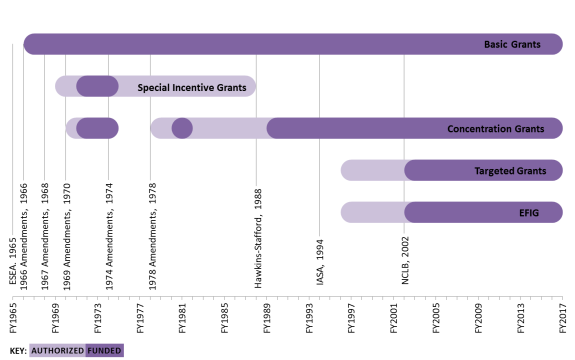

History of the ESEA Title I-A Formulas - EveryCRSReport.com

Taxing the Rich More: Preliminary Evidence from the 2013 Tax

Withholding Refund u/s 241A of Income Tax Act, 1961

Voting Rights Act of 1965 - Wikipedia

Tags:

archive