Major Change in Section 43CA of The Income Tax Act, 1961 Tolerance limit is now 20%

S-1

Guidelines on penalties for failure to furnish tax returns EY

S-1/A 1 a2241899zs-1a.htm S-1/A As filed with the Securities and

Challenges for companies during tax filing season Crowe Malaysia

Taxletter Issue 24 - ANC Group

Challenges for companies during tax filing season Crowe Malaysia

Reasonable Cause to Avoid Tax Penalties

Chapter 3. Taxation of Companies. Definition. Tax Status of

Full article: Joint Analysis of Corporate Decisions on Timing and

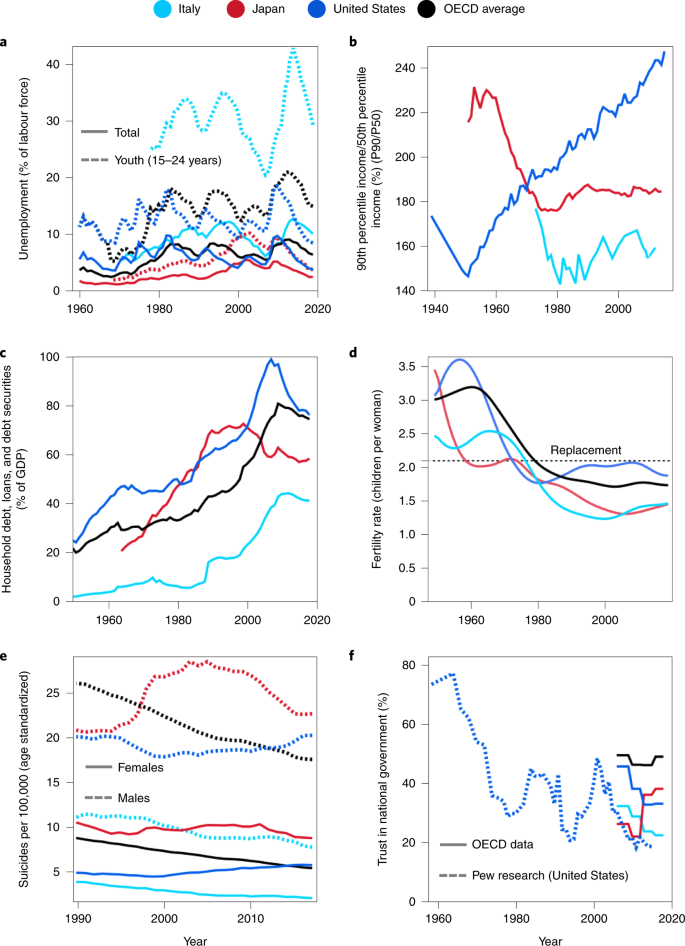

Prepare developed democracies for long-run economic slowdowns

Chapter 3. Taxation of Companies. Definition. Tax Status of

Tags:

archive